While history is rich with game-changing Black leaders who transformed the financial industry, changes in financial education remain vital to improving the current economic standing of African Americans—a status that recent reports have highlighted as troubling.

The Teachers Insurance and Annuity Association of America (TIAA) Institute’s Personal Finance Index (P-Fin Index) “measures eight key areas of personal finance knowledge: earning, consuming, saving, investing, borrowing and managing debt, insuring, comprehending risk and uncertainty, and go-to information sources,” according to the National Urban League. Reports from the TIAA indicated that “African-American adults answered 38 percent of the P-Fin Index questions correctly, compared to 55 percent of white adults.”

What causes such a substantial gap? Demographics naturally influence the ability to receive a formal education; the wealthier can afford a better education, leading to greater financial literacy. Yet, according to the same report, “financial literacy is still lower for African Americans compared to whites in each demographic subgroup.” This tells us that the cause for financial disparities runs deeper than demographics.

Bridging this gap and targeting growth areas in financial education will take collective efforts from organizations, governments, and groups nationwide. However, for change to begin, one must have the motivation, drive, and belief that it’s possible.

To celebrate Black History Month, we’re reflecting on trailblazers of the financial industry, both past and present, who have paved the way for underserved communities, demonstrating that change is more than possible. Join us as we unpack incredible stories of black individuals who harnessed the power of education and determination to alter the course of history.

Maggie Lena Walker

“There is no such thing as standing still: you must go up or down; you must increase or diminish; you must grow or decay; you must spread out or shrink up – you can’t stand still.”

-Maggie Lena Walker

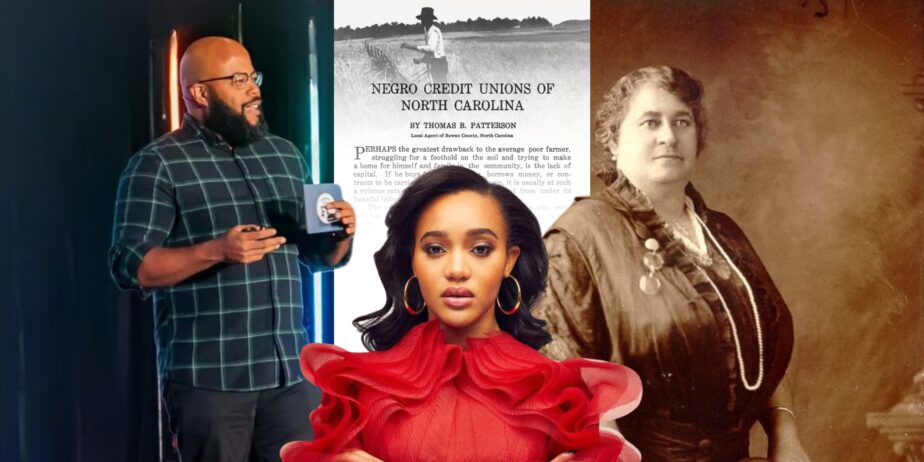

Studio Portrait of Maggie L. Walker, early 20th century. Courtesy of National Park Service, Maggie L. Walker National Historic Site.

Maggie Lena Walker was the first woman and black woman to own a bank and serve as a bank president in the United States. Born in 1864 in Richmond, Virginia, she lived during the age of restrictive Jim Crow laws.

After her father’s untimely death in 1876, her mother began a laundry business to survive poverty. Walker started working there at just nine years old but received a public school education and secured a job as a teacher after graduating high school.

In 1886, she was forced to resign from her teaching position since the Richmond school district did not permit married women in the role. From there, she joined the local council of the Independent Order of St. Luke, a fraternal organization that helped African Americans financially and socially. She would go on to serve as its grand deputy matron and then as its grand secretary. To increase publicity for the organization and share progressive ideas, she established the St. Luke Herald in 1902, a newspaper that would help increase membership from 3,400 in 1890 to more than 70,000 in 1924.

Her success and reach within the Order enabled her to charter the St. Luke Penny Savings Bank in 1903, serving as president until 1929. The bank enabled the black community to gain independence and financial abilities they couldn’t receive from white-owned banks. But Walker didn’t stop there! In 1905, she opened the St. Luke Emporium, a department store that offered more affordable goods to the black community and provided black women with work opportunities.

Thomas Patterson

“It is not what a man makes that gives him standing in the community; it is what he saves that counts. The [credit] union helps him to save.”

-Thomas Patterson

Thomas Patterson established Piedmont Credit Union, the first African American Credit Union in the United States, organized in April 1918.

The credit union specifically sought to help black farmers within Rowan County, North Carolina. While slavery was abolished in 1865, black individuals still faced hardships 53 years later, especially when it came to affording and accessing farming resources. In fact, African American farmers needed a white man to vouch for his character when applying for a loan.

On top of racial injustice, finances were challenging to manage. At the time, African American farmers suffered due to the “crop-lien” system, where crops were used as collateral to get a loan for resources from supply stores. This was appealing to farmers who couldn’t afford to buy supplies. However, excessively high interest rates (around 50%) made it nearly impossible for African American farmers to make any profit, especially if their crops failed that season. This trapped black farmers into an unfair system of renting land from plantation owners and going into debt with local shop owners.

Determined to make a change, Patterson suggested a system that eliminated the dependence on supply stores. When farmers needed a loan, they could borrow money at a fixed interest rate of 6%, allowing them to buy supplies in the open market rather than unjust supply stores. The credit union was so successful that it paved the way for 13 additional black credit unions to form in North Carolina by 1920, just two years after Piedmont’s founding.

Lauren Simmons

“I tell people you have to be comfortable with being uncomfortable in these spaces. The biggest growth comes from putting yourself in a new environment.”

-Lauren Simmons

Photo of Lauren Simmons. Courtesy of Lauren Simmon’s Instagram @lasimmons

In 2017, at just 22 years old, Lauren Simmons became the youngest trader and second-ever African American female trader on the New York Stock Exchange (NYSE), pinning her as the “Wolfette of Wall Street.”

After studying genetics in Georgia at Kennesaw State University, Simmons moved to New York with no finance degree but a dream to find her true passion, which she believed was outside the medical field. It was statistics that bridged the gap between finance and genetics, helping her secure a position at Rosenblatt Securities. However, Simmons needed to pass the Series 19 exam to earn her badge to trade on the NYSE. While 80% of exam participants do not pass, Simmons did. Simmons worked as a NYSE floor trader for two years, making $12,000 annually.

“While no one was overtly racist, sexist, or inappropriate to my face, it was glaringly obvious that there was an unspoken camaraderie that I would never be privy to. At first, I was invited to parties and warmly introduced to clients. I felt as though I belonged. That energy swiftly changed as my story — being the youngest female equity trader on the floor — captured the attention of the media. Then I began to get shut out…I did have a handful of professionals around me who were champions of my success, and I did lean into them deeply, like Richard Rosenblatt, the executive governor of the NYSE. He still graciously remains a close mentor of mine. Another ally was Bobby Greason, my direct supervisor and the head floor trader at Rosenblatt Securities. He taught me that these mishaps don’t define us or our future.”

Simmons decided to leave the NYSE and pursue a career in entrepreneurship where she could prioritize happiness, fulfillment, and passion. Since this decision, she has become a renowned speaker, producer, writer, and podcaster. Check out her podcasts entitled “Money Moves” or her book “Make Money Move: A Guide to Financial Wellness.” Additionally, she serves as executive producer on Midas Touch, a film based on Simmons’ story currently in preproduction. And if that wasn’t enough, she works with J.P. Morgan Wealth Management and SpringHill to host “With The Bag To Match,” a show dedicated to financial conversations with women of color.

Chris Browning

“You’re in the process right now of growing and developing into who you need to be to be ready for the opportunities when they come along.”

-Chris Browning

Photo of Chris Browning. Courtesy of the Popcorn Finance Website.

Initially studying to be an art major, Chris Browning discovered his love for personal finance after taking a finance class for fun and realizing how little he knew about the subject. After switching his major to financial planning and graduating in 2010, he served as a financial analyst and accountant. Then, in 2017, Browning launched Popcorn Finance, an award-winning podcast with over 1.7 million downloads. The show aims to discuss financial topics in the time it takes to make a bag of popcorn.

What makes Browning’s approach to finance so valuable is that he adheres to the current trends in media consumption. As the average attention span of a human adult is 8.25 seconds, short-form media is king in the trending world of Instagram Reels, TikToks, and YouTube shorts. Browning uses this to his advantage, breaking down personal finance into digestible segments that are easy for beginners to understand.

Browning also contributes to PBS, CNBC, The New York Times, The Los Angeles Times, Yahoo, and Newsweek and is a Men’s Health magazine columnist. You can see more of Browning’s work in Truiliant Federal Credit Union’s short-form educational series called “Money Burst,” or on New England Cable News as a weekly on-air personal finance contributor.

Next Steps

To invest in your financial education, view our informative articles, check out our social media pages, or contact us for helpful resources. We’re here to help you grow!

Sources

Maggie Lena Walker Sources:

- Boomer, Lee. “Life Story: Maggie Walker.” Women & the American Story, 8 July 2022, wams.nyhistory.org/modernizing-america/modern-womanhood/maggie-walker/.

- Editors, Biography.com. “Maggie Lena Walker Biography.” The Biography.Com Website, 2014, www.biography.com/business-leaders/maggie-lena-walker.

- Norwood, Arlisha R. “Maggie Lena Walker.” National Women’s History Museum, 2017, www.womenshistory.org/education-resources/biographies/maggie-lena-walker.

Thomas Patterson Sources:

- Advia Credit Union. “February Is Black History Month.” Advia Credit Union, 2024, www.adviacu.org/learn/advia-financial-blog/post/advantageswithadvia/2024/02/01/february-is-black-history-month.

- Connexus Credit Union. “Pioneering: Thomas Patterson & Piedmont Cu.” Connexus Credit Union, www.connexuscu.org/blog/connexus-news/credit-union-pioneers-thomas-patterson-piedmont-cu. Accessed 14 Jan. 2025.

- Hardy, Ronaldo. “America’s First Black Credit Union: Learning from a Pioneer’s Own Words.” CU Strategic Planning, CUStrategicPlanning, 26 May 2022, www.custrategicplanning.com/post/america-s-first-black-credit-union-learning-from-a-pioneer-s-own-words.

- Carolinas Credit Union League. “History of Carolinas Credit Unions.” Carolinas Credit Union League, 11 Nov. 2024, carolinasleague.org/about/history/history-of-carolinas-credit-unions/.

Lauren Simmon Sources:

- Bondy, Halley. “She Was the NYSE’s Youngest Female Trader. Now She’s Sharing Her Best Money Tips.” MSNBC, NBCUniversal News Group, 30 Sept. 2021, www.msnbc.com/know-your-value/best-money-advice-youngest-female-trader-have-worked-nyse-n1280453.

- Connley, Courtney. “How This 23-Year-Old Became the Only Full-Time Woman Trader at the New York Stock Exchange: Execution Services: Press Mentions.” Rosenblatt, Rosenblatt Securities, 19 Aug. 2023, www.rblt.com/news/how-this-23-year-old-became-the-only-full-time-woman-trader-at-the-new-york-stock-exchange-copy.

- Galloway, Alexandra. “Lauren Simmons, Who Became the Youngest Trader to Ever Walk the Floor of the New York Stock Exchange at 23, Doesn’t Believe in Failure.” Pulse Spikes, Pulse Spikes, 5 Nov. 2020, pulsespikes.org/archives/lauren-simmons#:~:text=In%20New%20York%2C%20she%20networked,that%20she%20could%20do%20it.

- Simmons, Lauren. “At 22, I Was the Youngest-Ever Woman NYSE Floor Trader and Making $12,000 a Year. I Walked Away after 2 Years and Never Looked Back – Here’s What the Experience Taught Me.” Business Insider, Business Insider, 2021, www.businessinsider.com/wall-street-youngest-woman-trader-lauren-simmons-2021-3.

- Simon, Jordan. “’Midas Touch: Chloe Bailey to Star as Historic Wall Street Trader Lauren Simmons in Film, Numa Perrier to Direct – Blavity.” Blavity News & Entertainment, 2022, blavity.com/midas-touch-chloe-bailey-to star-as-historic-wall-street-trader-lauren-simmons-in-film-numa-perrier-to-direct.

- Women’s Conference of Florida. “Lauren Simmons.” Women’s Conference of Florida, 2023, womensconferenceofflorida.com/speakers/lauren-simmons/.

Chris Browning Sources:

- Popcorn Finance. “Welcome to Popcorn Finance.” Popcorn Finance, 2025, popcornfinance.com/.