Who’s that knocking at the door? It might just be your next big investment: a condo. Whether you're a first-time buyer, aspiring landlord, or ready to downsize, a condo could be the real estate investing opportunity you’ve been searching for. In this blog, we’ll get comfy with condos, discover the pros and cons, and explore helpful ways to take advantage of this housing solution. To conDO or conDON’T, that is the question.

What is a Condo?

Before you grab some brown boxes and start packing, let’s get comfortable with condos and how they work.

Short for “condominium,” a condo is a living space or unit within a larger multi-unit building. It’s like a beehive, with individual hexagons serving as separate spaces within the larger structure. And just like honey, it can be a pretty sweet situation, especially since you can privately rent out your unit and benefit from property appreciation over time (stay tuned for more).

Amenities

Outside individually owned units, condo owners can access convenient common areas within and on the property, such as a gym, lobby, tennis court, or pool. These shared spaces are owned and maintained by an elected group of fellow unit owners called the Homeowners Association (HOA). Along with managing responsibilities like yard work and snow removal, HOAs help make decisions, set regulations, and establish and collect fees for the benefit of all residents. Think of HOAs like queen bees: part of the hive but with more control over what happens within.

Renovations

On your search for a condo, you may find one that needs some tender loving renovations. When you buy a condo, you own the interior of your unit. So while there may be some HOA limits on renovations (timing, materials, unmovable structures, etc.), you’re free to transform the space how you see fit. Just check with the HOA first!

Before renovating, consider your goals. Are you renting, reselling, or staying put? Objective upgrades are beneficial for an easier selling experience. On the other hand, if you want cheetah-print wallpaper in your home, you can have cheetah-print wallpaper!

HOA Fees

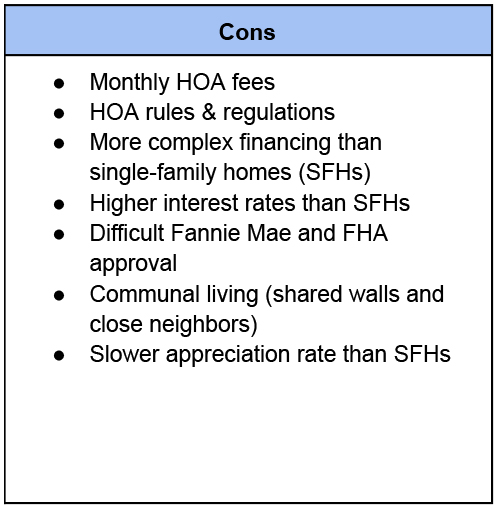

Sounds too good to be true? Here’s the (relatively small) catch. While condominium associations are responsible for building upkeep, they can charge condo owners monthly fees for property maintenance, management, taxes, insurance, and utility fees. What you’re charged depends on each association and can change over time, but Condo Manager USA reports a national average condo fee of $350 per month. For some owners, the time and expenses they save on property management and amenity access are worth the cost. For others, not so much. Consider your budget and goals!

HOA Bylaws

Investing in a poorly managed condo can significantly affect its money-making potential. Fortunately, HOAs have bylaws that protect both the association and residents. These bylaws define and create the association's structure, including information about member meetings and elections, protocols, fee regulations, rule enforcement, occupancy limits, and additional board duties.

FHA and Fannie Mae Approval

If bylaws sound like a hassle to navigate, I have good news. HOAs approved by Fannie Mae or the Federal Housing Administration (FHA) meet requirements and regulations that increase the credibility and reliability of the management team, providing buyer protections, easier financing opportunities, and increased marketability (see our “First Time Homebuyer” section for more details). Contact the HOA for public records and management information, or complete a search using an FHA Condo Lookup Tool to check a condo’s approval status.

At the end of the day, HOAs aren’t out to get you. They are composed of fellow unit owners, so the rules, fees, and standards they set affect them, too. They don’t want to sink their own ship. So while there is always a chance for less-than-preferred management, there are key qualifications you can look out for to get peace of mind.

Reasons To Get A Condo

Now that we have the big idea packaged up nicely, let’s get moving!

First Time Homebuyer

According to YCharts, the median sales price of a condo in April 2025 was $363,000, while the median sales price of an existing single-family home (SFH) was $418,000.

That’s a $55,000 price difference! Why?

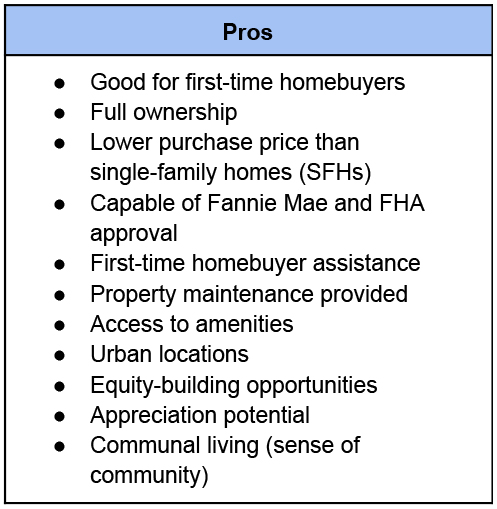

With a condo, you’re getting less privacy, no private land, and more rules and regulations in your everyday life. Bummer. However, you’re getting your own private space, easy access to amenities, and building your home equity and investment opportunities.

Further, recall our conversation about Fannie Mae and the FHA. If your condo is approved, you can benefit from conventional mortgage loans, FHA loans, first-time home buyer grants, and federal financing, just like with an SFH.

While your condo may be eligible for financing, receiving this help for a condo is more complex than for an SFH. It’s no small feat for a condominium project to be approved by Fannie Mae, as the HOA must overcome many documentation, insurance, and financial hurdles. This means more steps are required to secure a mortgage, and the interest rate might be higher than an SFH because condos are riskier for lenders.

That said, a condo can be a great starter home for a single individual or a new couple, serving as a convenient space to settle without the stress or budget-bending expenses of maintenance or memberships.

Renting and Reselling

Your family is growing, and the condo isn’t cutting it. No problem! Many HOAs allow owners to rent out their units, allowing you to become a landlord while moving on to your next home. That way, you maintain ownership and build long-term wealth through real estate.

By renting out your condo, you create a source of additional passive monthly income, and the property appreciates over time. This means a significant return on investment, whether you rent or decide to sell. Plus, you can typically deduct expenses to the condo from your income, lowering your taxes.

Renting Risks and Considerations

However, profiting off of a condo isn’t confirmed. Markets fluctuate, demand shifts, repairs are costly, and tenants can be challenging. There are always risks to consider, and the role of a landlord isn’t for everyone.

To determine if you can rent your condo, contact your HOA for rules and regulations. There may be limits that sway your decision and renting abilities, such as lease term requirements, rental caps on the ratio of rented to non-rented units in the condominium complex, and any required time that the owner must live in the unit before renting.

Last but not least, finding and screening renters is a whole different beast. Here are some things to keep in mind:

● HOA limits

● Setting your rent price

● Your insurance coverage

● Finding tenants (Zillow, Facebook Marketplace, apartments.com, realtor assistance)

● Screening tenants (HOAs may be involved)

● Managing leases

● Collecting rent

● Satisfying tenant needs (repairs and issues)

Vacation Rentals

Location is a significant selling point for condos. Most are in bustling urban areas with plenty of resources, such as easy access to entertainment, shopping, and city life. Others, specifically those with short-term or vacation rental opportunities, are located in popular tourist destinations with a steady stream of travelers.

With built-in amenities and included property maintenance, condos often appeal to both owners and guests. As the owner, you can access the rental yourself when you want, you don’t have to worry about exterior property maintenance, and your guests enjoy the amenities.

Vacation Rental Considerations

Vacation rentals aren’t a hands-off investment, and difficulties may arise if you’re not near the property. Consider that interior unit repairs, emergencies, and cleaning fall to you. If you are not there to satisfy these needs, you’ll need to hire a property management company to assist.

So while vacation rentals can be a good investment opportunity, consider:

● Seasonal demand may cause rental income to fluctuate.

● HOA rules may restrict short-term rentals or impose limitations that affect guest stays.

● Additional cleaning, upkeep, and management costs can impact your profit margins.

Downsizing

Whether you’re an empty nester, tired of maintaining a larger-than-necessary property, or looking for a more affordable housing alternative, downsizing to a condo is a great option. Not only could you save money living in a smaller space, but you may also benefit from the communal benefits, such as a sense of community and opportunities for activity while taking it easy on the yard work.

Related Option to Explore: A Duplex

Bonus info! While it’s not a condo, a duplex might be a super similar alternative to consider if you like the idea of a condo but want more of a single-family home feel. A duplex is a multifamily home that looks like a single-family home on one plot of land but is separated into two units, either side by side or stacked.

Unlike a condo, the duplex owner owns the entire property, not just one unit. That means more responsibility over the property's exterior, but more living space and a sense of separation.

Duplexes operate like condos in that the owner can rent out the space, whether both units or just one. The main benefit is that there are no HOA fees, and it’s easier to finance. However, you lose the convenience of amenities and the lack of maintenance work.

How 1166 FCU Can Help

Ready to find your next home or rental property? Our certified financial counselors are available to help members navigate their next steps. Check out our mortgage services for additional information on helpful home-buying resources.