May is National Home Improvement Month, and we’re nailing down home improvements with the biggest bang for your buck, boosting your home’s equity, curb appeal, and even your return on investments. After all, what’s better than a dream kitchen that also increases your home’s value? “Nothing!” the crowd cheers.

Home Equity Recap

Home equity is your home’s current market value minus the amount you owe on your mortgage. It’s essentially how much of your home’s value you own outright.

Having a high home equity is often an indicator that you’re close to paying off your mortgage, which is something to celebrate. But the excitement doesn’t stop there. Home equity can be used as collateral for home loans (also known as second mortgages) or a cash-out refinance. While home loans, such as a home equity loan or home equity line of credit, can be used for a plethora of expenses, most people use them for home improvements, and there’s a good reason why.

Home Equity and Home Improvements

Home improvements are great for improving your home (no kidding, Sherlock!), but they can also boost your home equity. How? Improvements can increase the home’s market value, increasing your equity in return. Consider this: if I purchase a fixer-upper and make upgrades to the property, it becomes more valuable. That’s good news for me if I’m looking to secure a loan or sell the property for a profit down the line.

Measuring Worthwhile Improvements

Not every home improvement will add monetary value to your home. You might love the funky wallpaper you put up in your living room, but a future home buyer might think it’s the most horrendous thing they’ve ever seen. One man’s treasure is another man’s displeasure.

If your goal is to boost home equity, focus on improvements that objectively enhance the home’s value and appeal to a wide range of people rather than splurging on trendy updates.

When measuring and reporting the value of improvements, there are two terms to know:

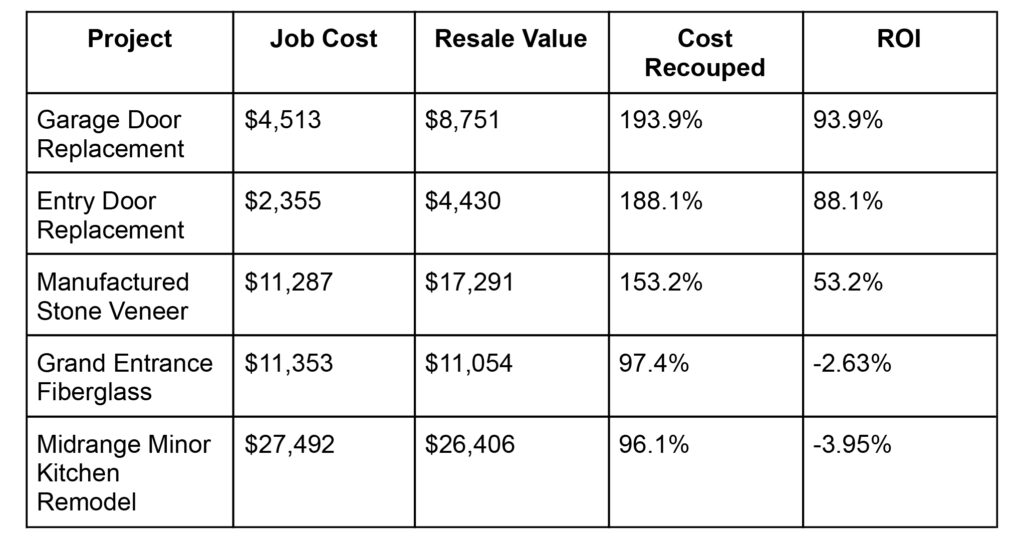

- Cost recouped: The amount of the initial investment that is recovered in resale value. You break even if you sell the investment for the same amount you paid.

Example: If I give you a cookie and you give me a cookie back, then 100% of my cost is recouped.

- Return on Investment (ROI): The profit generated beyond the initial investment cost. In other words, it’s the earnings after you break even presented as a percentage relative to the initial investment.

ROI = (Net Profit / Cost of Investment) x 100

Example: If I give you a cookie and you give me two cookies back, that’s a 100% ROI.

Is a Negative ROI Bad?

When revenue from an investment exceeds its cost, the ROI is positive. When revenue is less than the cost, the ROI is negative. Therefore, a positive ROI is ideal because it means you’re profiting from a monetary decision, rather than “losing money.”

Most home improvements don’t provide a 100% ROI due to changes in contributing market factors over time. Bummer, I know, but a negative ROI doesn’t always mean the investment was a mistake or not worthwhile.

Value Beyond Profit

Investing in your home can improve your quality of life, preserve its condition, and enhance its appeal by fixing areas that lower its value. In other words, while home improvements aren’t known to deliver profits like traditional investments, they can increase equity and overall satisfaction. So, you can boost marketability without a positive ROI.

Unless you’re a flipper focused on profit, the comfort and functionality of your space are more often the priority. It’s your home, after all! That said, we know you clicked to see those high-value improvements. Let’s break it down.

Contributing factors for ROI

The amount of ROI you receive can fluctuate depending on certain factors. Here are a few to keep in mind:

1.) The Project

Not all projects are created equal. As we will demonstrate later, some projects are less expensive and more desirable in the current market, which can drastically impact their ROI.

2.) Location

Regional differences can result in variations in the value of renovations and project costs. For example, a pool may be valuable to homeowners in Florida, but in Vermont it may be a deterrent. Renovation costs may also be higher in certain states due to factors such as labor rates and local market conditions.

Additionally, if more people are looking to move to the area you’re in, the demand may raise your property’s value.

3.) Moving Plans

The amount of time you live in your home after home improvements influences your ROI. If you’re looking to sell in the next few years rather than stay for an extended period, the ROI may be higher since the improvements will be recent and the market may be relatively stable.

4.) Time of Renovation

Depending on when you plan your improvements, the contractor may offer better rates and availability that could lower the project’s cost. For example, spring and early fall are great times for outdoor renovations.

5.) DIY and Quality

Doing projects yourself is a great option to save money on contractor expenses. However, you may have more peace of mind and high-quality results with professional help. Additionally, the quality of the home improvement may vary depending on the contractor used, the level of experience in project execution, the materials used, and other factors related to the installation process.

6.) Unexpected Costs

Expect the unexpected. Whether it’s a rise in property taxes or issues that need to be addressed to complete the initial home improvement, the cost of the renovation may increase unexpectedly.

Calculating The Value of Your Home

While there is a direct formula to calculate ROI, determining the current market value of your home can be a more challenging task. To get an idea, you can find real estate comps of houses that are selling or have been sold that share similarities with your property in terms of location, square footage, renovations, and so on.

Sites like Zillow or Realtor.com are a good starting point before seeking out a real estate agent or appraiser for professional input.

Top 5 Renovations for Cost Recouped

Source: 2024 Cost vs Value Report

HELOCS and Home Equity Loans

Take a look around your home. See some areas that could use some extra love? Take advantage of your home equity with competitive rates and flexible options for HELOC and home equity loans provided by 1166 FCU.