March is the month of four-leaf clovers and Leprechauns, but did you know it’s also the perfect time to learn about credit and credit scores? That’s because March is National Credit Education Month! What’s even better? You don’t need any luck to be a credit expert!

What is Credit?

Let’s start at the beginning. What IS credit? If we flip open the history books, we’ll find that the word “credit” first appeared in the 1520s. Individuals within the financial industry would use the word “credit” when referring to loan reliability and trustworthiness.

Little has changed with the way we refer to credit today. Credit is your ability to borrow something of value from a lender with the understanding that you will pay for it later.

Say a good friend, Joe, borrowed $100 from you. Two months go by, and Joe still hasn’t paid you back, but he calls you and asks for $50 more. You might hesitate to let him borrow additional money from you. As much as you want to help your buddy, Joe has “bad credit” (poor financial behavior). When you have “good credit,” you have a reputation for paying back what you owe on time. You are trustworthy when it comes to finances, unlike Joe.

What is a Credit Score?

A credit score is a numerical expression representing how likely you are to repay what you owe as a borrower.

How is My Credit Score Calculated?

Before we talk about calculations, it’s important to note that your credit report differs from your credit score.

Your credit report is a summary of your credit history.

Your credit score is a snapshot of your creditworthiness.

Your credit score is calculated using information on your credit report, such as payment history. Therefore, if there is an error on your credit report, it could affect your credit score. Credit reports typically do not include your credit score, but lenders may refer to these reports to determine your creditworthiness. You can access free weekly online credit reports by visiting https://www.annualcreditreport.com/index.action.

Various models are used to calculate credit scores, each with their own way of assigning value to contributing factors. Therefore, your score may vary depending on the model used. Fair Isaac Corporation (FICO) and VantageScore are the most commonly used models, so we will examine their algorithms to understand the contributing factors better.

According to the company, FICO scores are used by 90% of top US lenders today.

FICO scores use data that fall into five categories:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit (10%)

- Credit mix (10%)

VantageScore uses the six following categories:

- Payment history (40%)

- Depth of credit (21%)

- Credit utilization (20%)

- Balances (11%)

- Recent credit (5%)

- Available credit (3%)

As you can see, there are differences between the two algorithms. Even within FICO and VantageScore, alternative models, such as FICO Score 8, vary in categorical weight.

To determine which model to use, assess why you are checking your score. For example, FICO Score 8 can help you determine which credit cards you qualify for. FICO Auto Scores can assist with auto loans. VantageScore does the trick if you want to track your score over time. If you know you have high balances on your credit accounts, consider models such as VantageScore 4 (balances account for 6% of your score in this model).

Let’s unpack some of the common factors that contribute to credit scores:

Payment history

This category looks at your bill-paying habits. Do you have many late payments? When was the last time you made a late payment? Do you pay your accounts on time? The answers to these questions contribute to your payment history.

Amounts owed

Amounts owed is, you guessed it, how much you owe. It’s how much debt you have. If you are using a large portion of your available credit, meaning you owe a large amount of money, lenders may interpret that to mean you have a higher risk of failing to repay them on time.

Depth of credit / Length of credit history

How old are your credit accounts? Depth/length of credit factors in your youngest, oldest, and average account age. This category examines how long you have had and used credit. When you have older accounts, it shows lenders how you manage your money over long periods. Remember, these models are designed to show your financial reputation and trustworthiness. Lenders want to feel confident in their decision to lend to you. In your VantageScore credit score, your credit mix is combined with the length of your credit history to get your depth of credit.

New credit

Recently added, typically within the past 6-12 months, credit lines or loans are considered new credit. For example, applying or opening a new credit card is new credit.

Recent credit

Recent credit and new credit are similar. However, it looks at the number of hard inquiries on your report. Hard inquiries are deep dives where lenders request to review your credit reports to determine your reliability, and they occur when you apply for a new loan or line of credit. Possessing hard inquiries on your credit report can negatively impact your credit score.

Credit mix

Your credit mix is like a bowl of soup where all the differing credit types are the ingredients. Different types of credit include Installment loans, lines of credit, credit cards, and mortgage loans. While you don’t need one of each, it can increase your score if you have a mix.

Credit utilization

Credit utilization, more commonly referred to as your credit utilization ratio, is the amount of credit you use (the sum of all your revolving account balances) divided by your total available credit (the sum of all your credit limits). Typically presented as a percentage, your ratio shows lenders how much available credit you currently use and how you manage your debt. This rate should be low, preferably under 30%. A higher percentage indicates that you spend more money than you have available.

Balances

This category examines the total balance you have on all your credit accounts. Avoid having high balances to maintain a good score.

Available credit

Available credit refers to how much credit you have available to you on all your revolving credit accounts. With a revolving credit account, like a credit card, the account holder can borrow money repeatedly up to a set amount while paying back what they owe.

How Do You Get Your Credit Score?

You can access your credit score from a credit card, loan statement, or financial institution. You can also purchase credit scores from providers or use credit score services/sites. For example, Experian offers a free FICO score calculation. Equifax offers Equifax Core Credit, which provides a monthly VantageScore credit score and Equifax credit report.

What is a Good Credit Score?

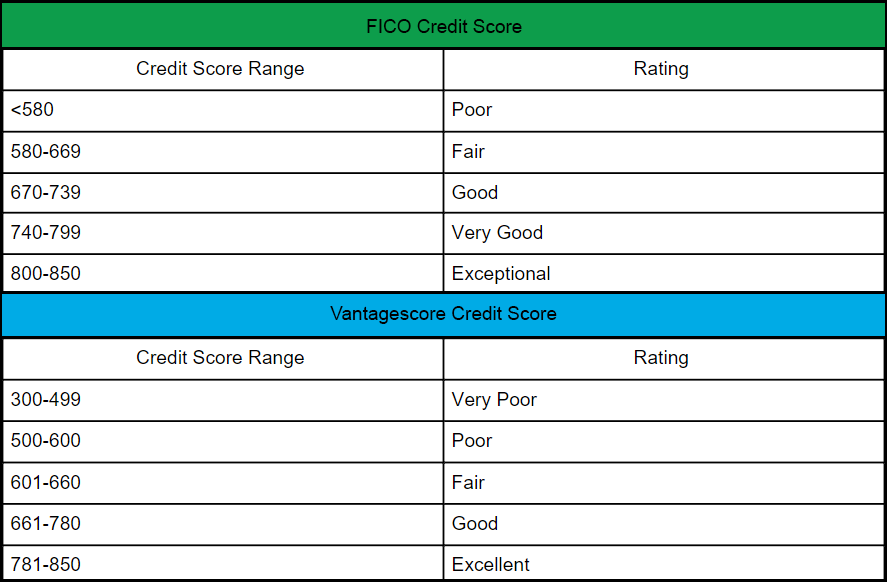

Most credit score models range from 300 to 850. Refer to the following tables to determine if you have a good credit score according to the FICO and VantageScore models.

Why Does Having Good Credit Score Matter?

Remember Joe? He doesn’t have a good financial reputation, making him harder to trust with financial responsibilities. A good credit score matters because it signals to banks and lenders that you are reliable. When your credit score indicates that you are financially responsible, less incentive exists for lenders to charge high interest rates. A higher score helps you qualify for credit cards, loans, and mortgages with low interest rates. In addition, good credit is valuable when renting an apartment and applying for jobs.

How Can I Build Credit?

Now that you know the ins and outs of credit, you can build and raise it effectively. Here are a few ways you can improve your score:

- Pay your bills on time

- Review your credit reports for errors

- Become an authorized user

- Apply for a secured card

- Get a student credit card

- Keep your credit utilization ratio below 30%

Read our blog about building a credit score for more information!