Creating a monthly budget brings out the imaginary angel and devil on my shoulders. The angel whispers, “I’m so proud of you! This will help you reach your goals and financial stability!” and the devil retorts with, “Remember that dress you saw on TikTok? What if we got Chick-fil-A on Monday…and Wednesday? What about your FOMO?!” It’s a constant battle.

Monthly Budgets & Increased Happiness

But wait a second. Buying a delicious coffee in the morning brings me happiness. I need to have joy in my life!!! Don’t worry. I am here to tell you that budgeting doesn’t mean completely ditching the products you love in order to be financially stable. It’s all about finding the balance. That’s why we call it balancing a budget; your monthly income works in symphony with how you use your money, creating an equilibrium between the two to achieve your goals. That’s why smart budgeting is a crucial and invaluable life skill.

What is Budgeting?

Budgeting is when you allocate funds to specific areas of spending and saving. It’s a practice that keeps you financially responsible, prepares you for the future, and helps you use money to accomplish your goals.

Embrace loud budgeting (talking openly about your money problems and goals). 84% of Americans say they need help with financial education and budgeting skills. It’s not embarrassing to prioritize smart money use. If anything, it’s impressive that you’re investing in yourself! I’ve never once met a person who regretted making a budget. I see people struggle with the consequences of irresponsible financial decisions daily. Which fate would you choose?

Let’s look at a few easy steps you can take to establish your monthly budget.

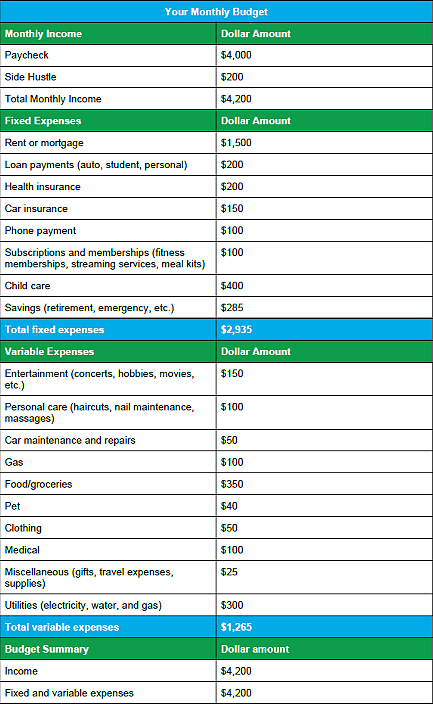

- Identify how much money you make each month (monthly net income)

This may seem like a no-brainer, but you need to know how much money you make in a month to distribute those funds throughout your budget. As this changes, so should your budget.

- Calculate your fixed and variable expenses

Expenses. These are all the things you pay for each month, taking away from the net income you get on payday. This step tells us where your money is going monthly. Pro tip: view your credit card statements to accurately depict your spending habits!

However, not all expenses are the same, and there are two types to manage: fixed and variable.

- Fixed expenses are the monthly bills you pay regularly. There is no change in how much money you need to cover these expenses. Examples include rent, utilities, gym memberships, car payments, etc.

- Variable expenses are more flexible and may change from month to month. This includes entertainment, gas, groceries, and most things you buy from a store. Medical and utility expenses can also fall under this category if your needs and usage levels are not consistent.

Add the cost of all fixed and variable expenses together to get your total expenses for the month.

- Subtract your total monthly expenses (step 2) from your total monthly income (step 1)

Time to find out if our spending habits have a good relationship with the amount of money we are bringing in each month. The goal is to have a positive number remaining after the subtraction. If it’s negative, you’re spending more money than you have available to spend.

- Adjust your budget

Okay, you did step three and you’re staring at a negative number. Dang it. What now? Time to adjust your budget. Prioritize your needs first (ex: rent) and then allocate funds to your wants (ex: buying more clothes when your closet is bursting at the seams). Create a blueprint for financial success that you can stick to and follow.

Let’s say you did step three and you have $50 remaining. Great, so you have $50 to splurge on during your next shopping spree! Right? You certainly could use your money in this way, but let’s look at all our options. Consider using that money to make an emergency fund, pay off credit card debt, or diminish your student loans. Make the most of your money and invest in your financial goals each month. Take the time to truly consider what spending and saving habits would best benefit you.

- Track your spending

45% of Americans DON’T track their spending. Stab me in the heart why don’t you!

Don’t fall into the trap of making a budget, but never referring to it throughout the month. You should know exactly where your money is going and how much!

There are plenty of budgeting apps out there that can help you stay on top of tracking your spending. Examples include Mint, EveryDollar, and YNAB. All of which happen to be free! Yay!

- Check back in regularly

Change is a natural part of life. As circumstances change, your budget will as well. Make the necessary adjustments to your budget each month so you can continue to stay on track with your goals.

Example of A Monthly Budget

Struggling with your budget?

1166 FCU provides financial guidance for all of its members. Talk to our team members about budgeting strategies and practices that work best for you.

Contact us

Browse our website for more information or contact us at (856) 542-9241 to speak to a member of our team.