The Batmobile, The Mystery Machine, The Ectomobile. Every Halloween hero needs their trusty set of wheels, and who’s to say an auto loan didn’t back these famous rides! As we officially enter spooky season, a popular time for new car releases and car buying, now is the perfect time to pop the hood on auto loans, unpacking what they are, how they work, and how they can help save the day when purchasing a car.

Unmasking Auto Loans

If you’re looking for a good scare this fall, check out current car prices. Yikes! An auto loan makes this payment a little less frightening, as it is a sum of money borrowed from banks, credit unions, or other lenders to finance the purchase of a vehicle, using the vehicle itself as collateral to secure the loan.

Auto loans are a popular option for individuals who prefer not to pay the full cost of a vehicle up front. Instead, a lender provides the funds to purchase the car, and the borrower repays the loan over time through monthly payments that include principal, interest, and sometimes additional add-ons, such as insurance.

These monthly payments are fixed, meaning they remain unchanged throughout the loan’s lifetime, also known as the term length. If you stop making payments on the loan, you can say R.I.P. to your ride, as the lender can repossess the car from you.

Auto Loan Terms To Know

- APR – APR (Annual Percentage Rate) is the yearly cost of borrowing money for a car, including interest and most associated fees, expressed as a percentage. It provides a more accurate picture of loan costs than just the interest rate.

- Loan Amount – The total amount of money you borrow to purchase a car.

- Monthly Payments – The amount you pay each month on your loan, including principal and interest. Extra payments can reduce the loan term and total interest paid.

- Down Payment – The amount paid upfront or via trade-in to reduce the loan balance. A larger down payment lowers monthly payments and total interest.

- Principal – A portion of your monthly payment that repays the original amount you borrowed.

- Interest – A portion of your monthly payment that is charged as a percentage of your loan balance for borrowing money. Borrowers with higher credit scores usually qualify for lower interest rates.

- Term Length – The period you have to repay the loan, typically 36–72 months. Shorter terms often have lower interest rates but higher monthly payments.

- Sales Tax – Most states require a sales tax for auto purchases, which will be factored into the purchase of your vehicle with the loan.

- Title, registration, and other fees – Fees collected by the dealership or state for vehicle registration, processing, and legal documentation.

- Early Repayment – Paying extra toward your loan each month can shorten its term and save on interest. Some lenders may charge a penalty, but 1166 FCU does not.

When are Auto Loans Helpful?

When considering an auto loan, there are some wheely-good (I couldn’t help it) reasons to use one! Check it out:

- Those With Less Purchasing Power

Young adults, recent graduates, and individuals on a tight budget… whatever your reason for not being able to buy a car outright, auto loans can help make the process easier. However, auto loans are not a green light for living beyond your means when it comes to vehicles. It’s intended to financially assist you, not plunge you six feet under a mound of debt because you wanted a Porsche.

- Individuals with less credit history

If you are responsible with your repayment schedule, that will reflect positively on your credit score. So, if you’re looking to build your credit history, auto loans can help you diversify your credit mix.

- Keeps money in savings accounts

When using an auto loan, your money can remain in accounts where it is currently earning interest, such as a high-interest savings account or investment account. Additionally, having money in accessible places rather than shelling out a large amount of cash at once can offer security in the case of an emergency.

Potential Auto Loan Pitfalls

Unfortunately, when managed poorly, auto loans can have their own skeletons in the closet. Here are some factors to watch out for:

- Debt

If you miss a monthly payment, it can be a slippery slope, making it difficult to catch up and potentially leading to costly debt.

- Credit Score

Missed payments can lower your credit score, negatively impacting your credit history and ability to qualify for loans and financial products in the future.

- Repossession

If missed payments are not repaid within a preestablished timeframe with your lender, it is within their right to repossess the car from you. You may be able to pay to get your vehicle back after repossession, but this is an emotionally and financially draining process.

- Value depreciation

According to Kelley Blue Book, new cars typically depreciate by about 30% over the first two years on average, and continue to depreciate by 8-12% each year thereafter. When the balance of your auto loan is higher than the value of your car, you’re in what’s referred to as an upside-down or underwater loan due to negative equity. This is unfavorable when you’re trying to finance a new car, as it adds an outstanding balance to the principal of the new loan, creating an opportunity for higher monthly payments and increased debt. In other words, it makes car buying harder in the future.

- Locked into one car

If you want to get a new car while still paying off an existing loan, you’ll need to trade in the vehicle, sell it privately, or pay off the remaining balance. In some cases, you can roll the balance into a new loan; however, this often increases both monthly payments and the total cost of the loan.

Who Offers Auto Loans?

There are four popular options for securing an auto loan: Dealerships, banks, online lenders, and credit unions.

Dealerships:

PROS:

- One-stop shop for cars, financing, and purchasing

- Potential network of lenders with different financing qualifications

- If the dealership has brand-specific (capital) lenders, they may offer rebates or attractive rates

CONS:

- Higher interest rates

- Sales pressure and upselling tactics

- Longer loan terms

- Limited to the dealership’s inventory

- Harder to compare actual loan costs across dealerships

Banks:

PROS:

- Let’s you shop around for the best loan

- Pre-approval avoids dealer add-on pressure and saves time at purchase

- Can be used at franchises, individual dealerships, and private sellers

- Possible perks if you’re already a customer there

CONS:

- May miss out on special dealer promotions

- Slower than dealer financing

- May be limited to approved dealers with higher rates

- Stricter eligibility requirements

Online lenders:

PROS:

- Quick approval and application process

- Easy comparison shopping

- Flexible for various credit histories

- Highly accessible

CONS:

- Less personal service

- Potential privacy and scam concerns

- Hidden fees

- Rates can vary widely

Credit Unions:

PROS

- Typically offers the lowest rates due to its member-owned structure

- Can be used at franchises, individual dealerships, and private sellers

- More lenient for members with limited credit or experience

- Personalized service

- Longer and more flexible repayment terms

- Lower/fewer fees

CONS

- Membership is required

- Fewer branch locations (but most offer online approval)

- May miss out on special dealer promotions

- Slower than dealer financing

What Factors Affect Your Rate?

Lenders determine the interest rate and the loan sum you are eligible for by looking at factors that indicate your creditworthiness. Some elements include:

- Credit score – a numerical expression representing how likely you are to repay what you owe as a borrower.

- Debt-to-Income ratio – the percentage of your total monthly income that is dedicated to debt repayment

- Employment history – demonstrates job stability and consistency of income to make payments.

- Income – Higher income indicates greater ability to repay debts, reducing the risk of missed payments and improving approval odds.

- Term length – Shorter term loans often have lower rates, while longer terms may carry higher rates.

- Down payment or trade-in – A higher down payment or trade-in value results in less money borrowed, decreasing the level of risk for lenders, which can — in turn — lower your interest rate.

- Vehicle type and age – Newer cars often qualify for lower rates, while older or used cars may come with higher rates, as they depreciate faster or are perceived as higher risk.

Auto Loan Example

Let’s put this new knowledge into practice!

Say you want to apply for an auto loan with your favorite local credit union (*cough cough* 1166 FCU *cough cough*).

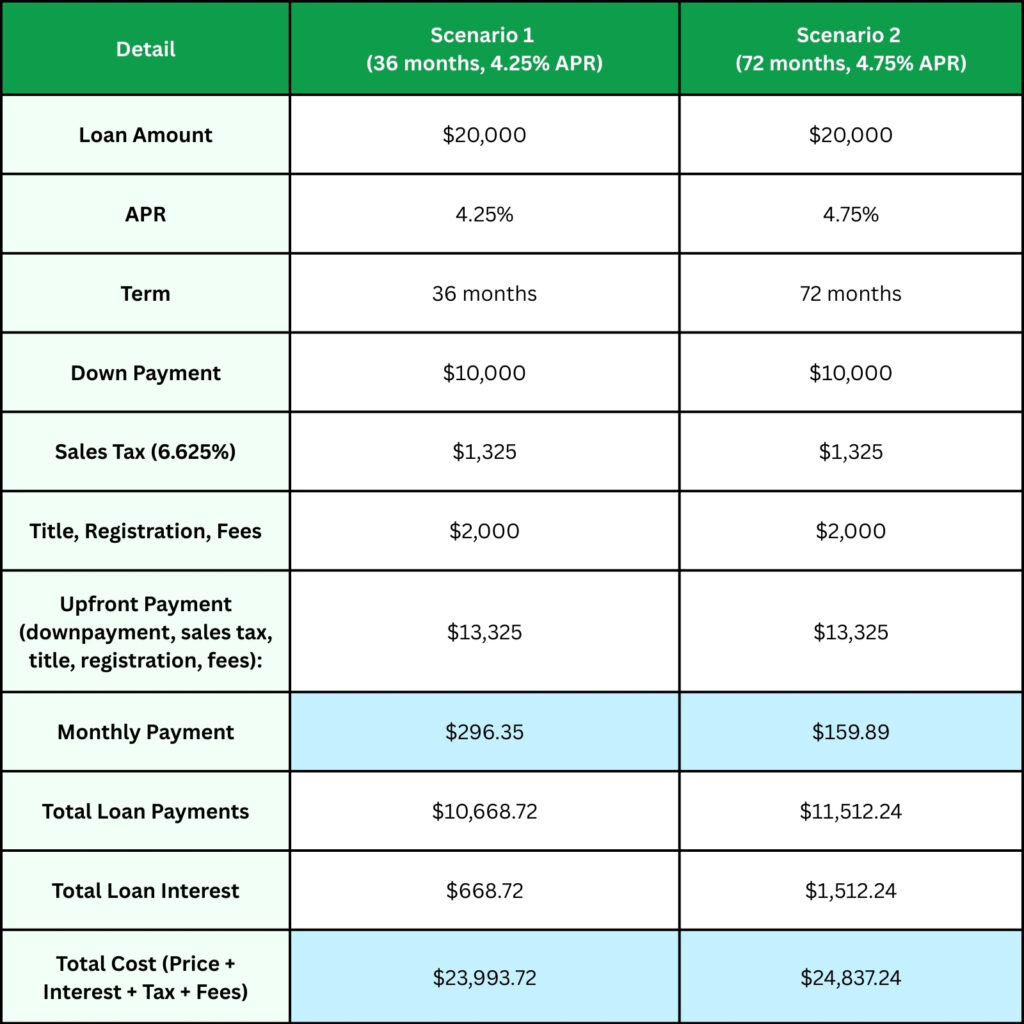

To demonstrate the significant financial difference that terms and rates can make, we’ll examine two different scenarios, assuming that you’d receive approval for either. The only difference between the two is that Scenario 1 has a 4.25% APR for 36 months, and Scenario 2 has a 4.75% APR for 72 months.

Using a handy dandy auto loan calculator, you can estimate the cost of these auto loans! For this example, you can expect the following:

As you can see, with Scenario 1, you’ll pay a higher monthly payment by $136.46, which means more of a monthly budget burden. However, with Scenario 2, you’ll pay $843.52 more in total loan costs. Therefore, depending on your goals and budget, one loan agreement may be a better fit for you than another.

Trade-In

If you already have a car, you can bring it to a dealership to determine its trade-in value. This value is applied directly to the purchase price of the vehicle you want to buy. The higher the trade-in value, the less money you need to borrow to finance through an auto loan.

If you’re using a loan from your credit union, the credit union provides the financing, not the trade-in. You can trade in your car at the dealership, and the trade-in value is applied toward reducing the amount you borrow from the credit union.

Example:

New car price: $30,000

Trade-in value: $5,000

Loan needed from credit union: $25,000

Refinancing

Refinancing an auto loan means taking out a new loan to pay off your current car loan under different terms. For example, if you wanted to refinance your Batmobile because a credit union offers better rates than your bank, you could do so to secure lower interest rates, more favorable repayment schedules, or loan terms that better fit your budget.

What Auto Loan Is Right for Me?

While it’s probably more fun shopping for the actual car than a loan, making sure that you scope out your best option is critical. Not all car loans are created equal. Interest rates, repayment periods, fees, and loan amounts… the priority of these factors in your life should influence what auto loan you choose.

Again, it’s critical to remember that auto loans are not designed to help you purchase a car you will struggle to pay back. They are helpful tools that can lighten the load of car purchases, but

should be paid off responsibly and promptly; otherwise, you risk slipping into debt or losing the car altogether. Take the time to consider what you’re looking for in a vehicle, as well as its financing.

Next Steps:

If you’re looking for an auto loan, you’re in luck. 1166 FCU offers low-rate auto loans throughout the year. However, this October (October 2025), we’re offering a LIMITED-TIME 0.25% rate reduction on new and used vehicles with direct deposit and auto pay. For example, that means members eligible for our typical 4.25% APR for 36 months can instead receive an interest rate of just 4.00% APR!

For New Auto Purchases only (New & Used Vehicles). Auto Lease Buyout & Auto Refinance are not eligible. APR = Annual Percentage Rate. Rates subject to change. Equal Opportunity Lender. Applications are subject to approval. Applicants must qualify for membership at 1166 FCU. Other terms and conditions may apply. Offer available throughout October 2025.