If there’s one thing I know about the investment world, it’s that it loves an acronym. But don’t let the technical name fool you: While ‘exchange-traded fund’ (ETF) doesn’t exactly sound thrilling, it could play a transformative role in the future of your finances.

With global assets invested in ETFs recently soaring past $19 trillion, the secret is officially out; savvy investors are taking advantage of ETFs for their 2026 portfolios.

So keep the “new year, new me” mentality flowing and explore why more investors are turning to ETFs and how you can do the same.

What is an ETF?

An exchange-traded fund (ETF) is a pool of money from a large group of investors that is used to purchase a diversified mix or “basket” of assets, such as stocks, bonds, or commodities.

ETFs are traded on the stock exchange just like individual stocks, meaning they can be bought or sold at any time during the trading day (9:30 AM – 4:00 PM ET). Hence the “exchange-traded” title. This offers investors flexibility and high liquidity, but it also means ETF prices can fluctuate throughout the day, unlike other investment funds, such as mutual funds.

Passive Versus Active ETFs

They say imitation is the sincerest form of flattery. If that’s true, passive management is a love letter to the stock market. Passive management for ETFs means the fund tracks a market index to perform similarly and match it rather than trying to beat it. Most ETFs are passive and ideal for investors looking to “set it and forget it.” They are often referred to as index ETFs.

On the other hand, actively managed ETFs use fund managers who aim to outperform the market by actively selecting which securities to buy and sell. This makes actively managed ETFs similar to mutual funds, but again, ETFs have a more flexible trading schedule. They are often referred to as active ETFs.

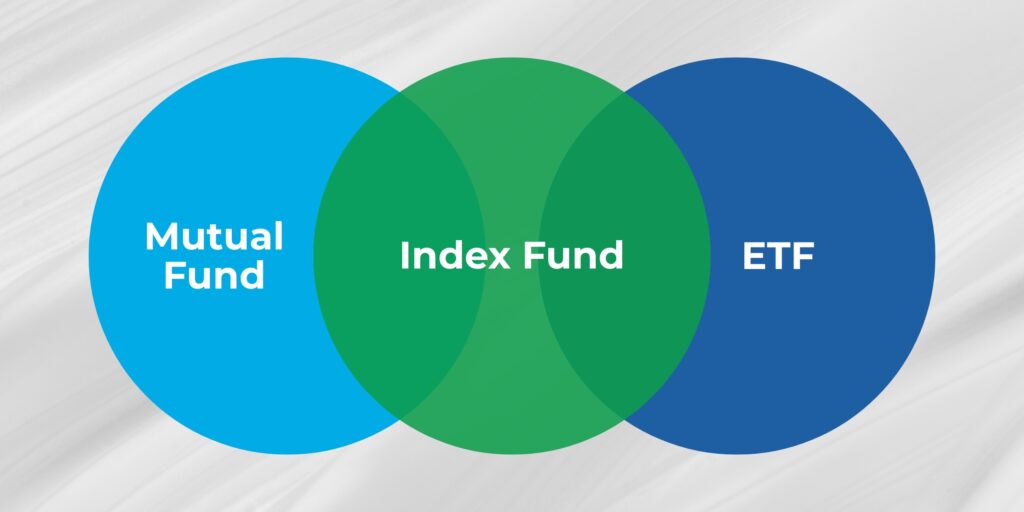

ETFs versus Mutual Funds versus Index Funds

If all the different kinds of funds are making your head spin, this section is for you.

When you see financial products with “fund” at the end, like mutual funds, exchange-traded funds, and index funds, it means they are pooled investments that purchase a basket of assets.

What sets different funds apart are features like:

- Investment strategy

- Management style

- Accessibility

- Fees

- Trading structure

- Investment specificity

When it comes to ETFs, the closest alternatives are mutual funds and index funds. Someone call a DJ, because we’re about to break it down:

ETFs are traded like stocks throughout the day at fluctuating prices.

Mutual funds are traded once a day at one price.

Index funds track a specific index to mimic the market, not beat it.

ETFs and mutual funds can both be index funds if they are passively managed. For example:

Index mutual funds are passively managed funds that are traded once a day at one price.

Index ETFs are passively managed funds that are traded throughout the day at fluctuating prices.

To keep it simple, if you see the word “index,” think passive management. Index funds are investment strategies, and ETFs and mutual funds are two different investment formats that can be index funds.

However, there are also actively managed ETFs and mutual funds, fittingly referred to as active ETFs and active mutual funds (could have seen that one coming!). As mentioned in the previous section, this management style utilizes professional fund managers to buy and sell assets for the fund’s investors.

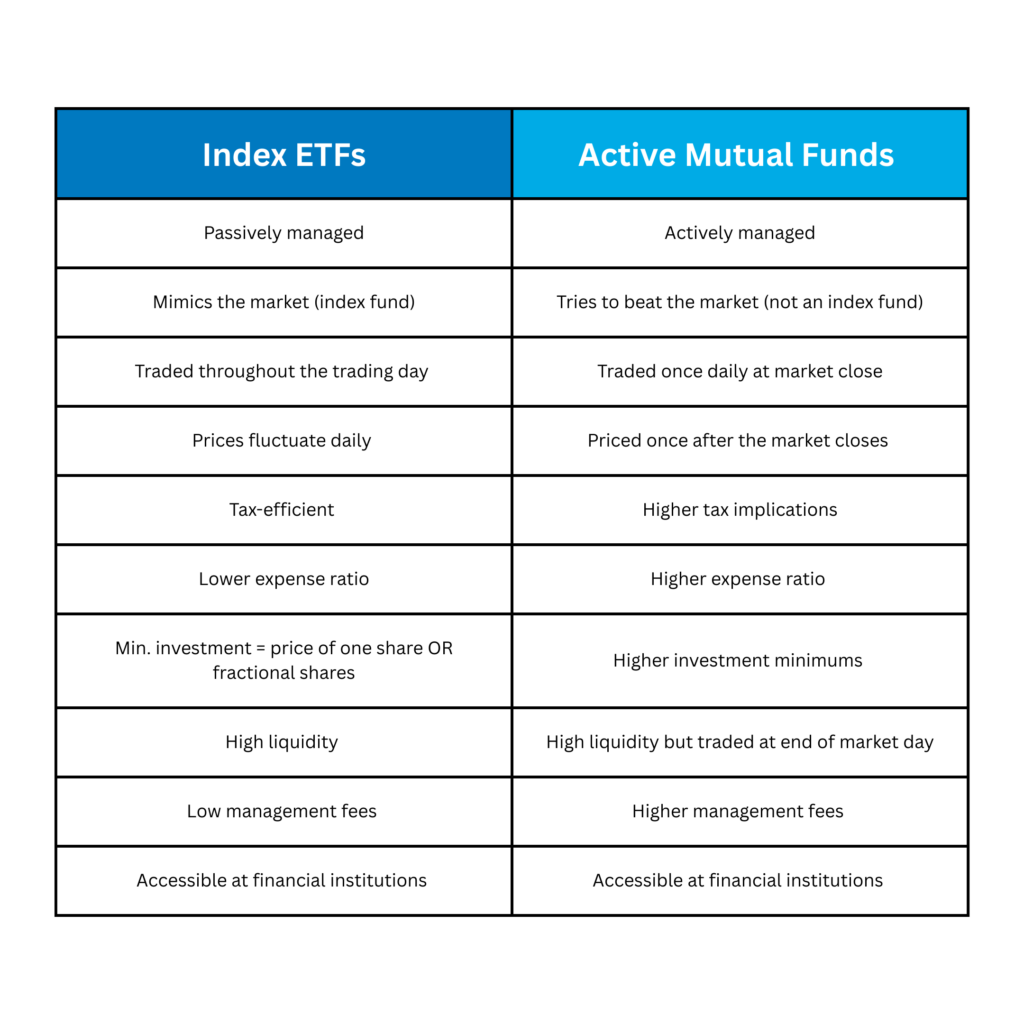

Which is Better: Index ETFs or Active Mutual Funds?

According to Morningstar data, the ETF market share relative to mutual fund assets has more than doubled over the past 10 years, jumping from 14% to 32%. Since most mutual funds are active, and most ETFs are passive, let’s compare the two to see why that might be the case:

Overall, index ETFs offer flexibility, lower fees, accessibility, and a hands-off approach that is attractive to investors looking to go with the flow of the market. However, active mutual funds have the potential to outperform index-reliant funds, which is something to consider when investing.

Advantages of ETFs

Not sure if an ETF is right for you? Check out its most attractive characteristics:

1. Diversification

Unlike buying stock in a single company, purchasing an ETF gives investors a diversified basket of securities, reducing reliance on any one company and helping lower overall risk.

2. Flexibility

ETFs are traded on the stock exchange just like individual stocks, meaning they can be bought or sold at any time during the trading day (9:30 AM – 4:00 PM ET).

3. Low Management Fees and Expense Ratios

Since ETFs are typically passively managed, investors don’t have to pay a professional to beat the market. Therefore, the fees are much lower and are usually included in the overall expense ratio, which covers expenses such as management, administrative, legal, and compliance fees.

4. Accessibility / No Minimum Investment

ETFs have no minimum investment, besides the cost of a single share, since they are bought and sold like stocks. This makes them highly accessible to investors of any experience level.

In addition, some brokerages offer fractional shares, allowing you to purchase portions of stocks for specific dollar amounts. This makes expensive assets more accessible. Some partial shares can be as little as $5.

5. High Tax Efficiency

Compared to other investment options like mutual funds, ETFs can be more tax-efficient. ETFs don’t trigger capital gains taxes like active mutual funds do because of the way that ETFs are swapped with institutional traders rather than sold for cash to create taxable capital gains.

Disadvantages of ETFs

Every rose has its thorns. While ETFs have many investment advantages, there are some disadvantages, such as:

1. Limited Control

ETFs are baskets of investments, so you don’t get to pick and choose what companies you do or do not invest in within the fund. You get what you get. While this is great for diversification, you may have companies in mind that you don’t want to support and invest in, which could make selecting ETFs more challenging.

2. Tempting Intraday Pricing

Since ETFs are traded throughout the market day at fluctuating prices, individuals can be emotionally swayed by price shifts, potentially leading to less thought-out decisions or added stress.

3. Limited Outperformance Potential

Index ETFs are not designed to outperform the market. Since it is designed to follow the market, you may not always see as much of a profit as you might with actively managed investment accounts, especially when the market goes down.

Different kinds of ETFs

Each ETF has a specific investment objective. This can include goals like tracking the broad stock market index, the price of a commodity, or narrowing in on a particular sector, such as technology or healthcare. Some popular ETF options include:

International ETFs: Invest in companies outside of the US

Sector ETFs: Invest in companies in specific industries (healthcare, real estate, energy, tech)

Divided ETFs: Invest in companies that pay dividends to shareholders

Commodity-Based ETFs: Invest in commodities (precious metals and agricultural resources)

Bond ETFs: Invest in a portfolio of bonds (government or corporate)

Not all ETFs are created equal. When selecting an ETF to invest in, consider its investment strategy, the risks, the costs, and your overall investment goals.

How to Invest in ETFs

Investors can start their ETF journey via online brokers, traditional broker-dealers, and through retirement accounts. Popular investment platforms include Vanguard, Fidelity, Charles Schwab, and J.P. Morgan. Different brokerages offer varying levels of customer support, education, ease of use, financial options, and more. Explore your options to find the platform you are most comfortable with!

Other Options

Still unsure about investing? While it’s not an investment account, money market accounts are one step above a regular savings account, offering higher interest rates for long-term growth.

1166 Federal Credit Union recently launched Money Market Plus, our latest money market account offering with our highest money market rate and the lowest required minimum deposit.

- 3.00% Annual Percentage Yield (APY*)

- 2 free withdrawals monthly***

- Minimum deposit of $2,500 to earn APY

Money Market Plus accounts are only available for new money, or funds that have not been on deposit with 1166 Federal Credit Union in the last 30 days.***

Learn more about our money market accounts, and contact us today to get started!

Disclaimers:

*APY = Annual Percentage Yield. 3.00% APY is accurate as of July 28, 2025, and subject to change at any time.

**Up to two free withdrawals per month without penalty, with additional withdrawals incurring a $25 charge per occurrence. Penalty fees may reduce earnings.

*** Transfers from existing 1166 FCU accounts alone do not qualify.