It’s the new year! You know what that means: New Year resolutions. While hitting the gym and eating healthier are popular resolutions for a reason, financial resolutions are the real unsung heroes of 2024 prepping.

Financial resolutions are the gateway to achieving additional yearly goals. For example:

- Creating a budget → ability to afford a gym membership

- Raising your credit score → mortgage pre-approval on your dream home

- Starting an emergency fund → less stress in the years to come

Unlock the full potential of 2024 by taking control of your finances. Here are three practical financial resolutions for the new year and ways to stick with them.

Create a Monthly Budget

Wow! Your federal credit union suggests that you track and save your money? Who would have thought?! Sarcasm aside, creating a monthly budget, or budget in general, is a huge step toward a financially successful year. In fact, a study done by Empower found that 53% of Americans say learning how to budget and track expenses is the most valuable money lesson they’ve learned.

According to a study by NerdWallet, nearly 1 in 5 Americans (18%) think their generation is bad at managing money. While most of the hard work is sticking to a budget, creating one can get your head in the money-managing game.

How Do I Set A Monthly Budget?

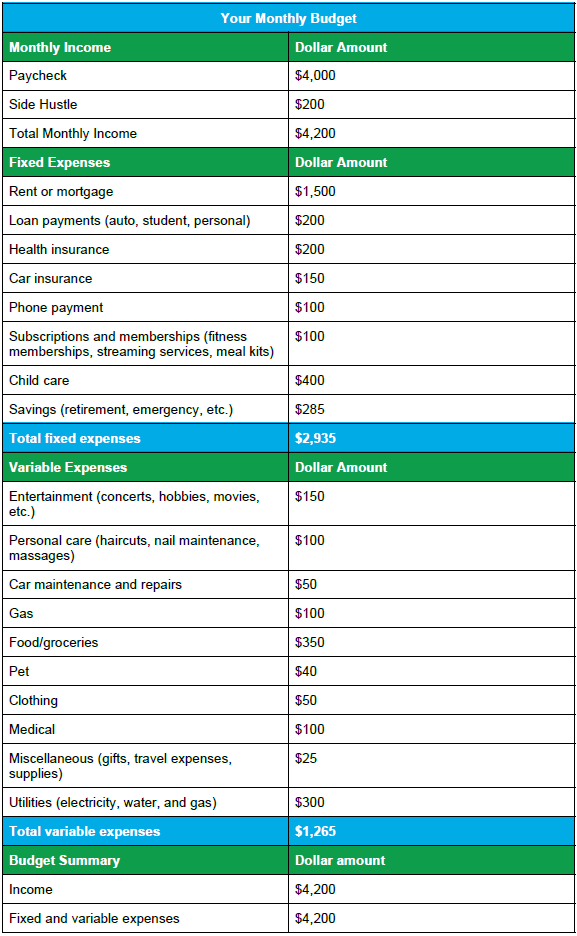

When you create a monthly budget, you allocate your income to fixed expenses (rent, insurance, car payments, etc.) and variable expenses (entertainment, groceries, personal care, etc.). If you’re struggling to determine how much to dedicate to each expense, look back at your credit card statements. Conveniently, most cards will give you an annual spending review that groups your spending by category: perfect for planning for the new year! Below is an example of a basic budget outline/example. You may need to add or remove sections to fit your lifestyle.

How Do I Stick To My Budget?

Revisiting and adjusting your budget each month helps you stay on track financially. Make it a habit to review your monthly budget on the first of each month or when you receive your paycheck. Set a reminder on your phone, put it into your calendar, or use a budgeting app like Mint, EveryDollar, or YNAB. By the way, all those apps are free!

Improve Your Credit Score

A good credit score provides you with benefits like better insurance rates, more access to loans and lines of credit, and mortgage pre-approval. Here are just a few of the ways you can raise your score:

How Can I Improve My Credit Score?

Regularly Monitor Your Credit

According to a 2021 study by the Federal Trade Commission, 25% of Americans have an error in their credit reports. Review your credit report to ensure no errors are bringing down your score. Free weekly online credit reports are available from Equifax, Experian, and TransUnion. You can request your free credit reports by visiting the AnnualCreditReport.com website.

Pay Bills on Time

If you’re anything like me, you may read this and think, “I wish I didn’t have to pay bills in general, let alone on time.” Understandable! However, paying bills by their due date plays a huge role in building and maintaining your credit score. It proves to lenders that you have a trustworthy payment history. Set up automatic payments, stick to a budget that allocates funds

for bills, or change the date you pay so it works best for your schedule. Word of caution: ensure your account has enough money to cover automatic payments to avoid overdraft fees.

Keep Your Credit Utilization Rate at or Below 30%

A credit utilization rate is the percentage of credit you actively use from the total amount of credit available to you. This rate makes up 30% of your credit score, so don’t put it on the back burner. High balances on credit cards and other lines of credit run up your utilization rate, harming your credit score in return. Therefore, the lower you can get this rate, the better. Keeping your utilization rate at or below 30% indicates to lenders that you have available credit and that you’re not overspending. One of the most straightforward ways to lower this rate is to pay off your credit card balances monthly. Aim to keep your debts low and your available credit high.

For more ways to increase your credit score, read our blog about building credit when you have none.

Start an Emergency Fund

No one can predict the future, but you CAN prepare for it. An emergency fund is specifically designated to cover unexpected, offset expenses. According to a 2023 report by Bankrate, 57% of U.S. adults are uncomfortable with the amount of emergency savings they currently have, and 22% of U.S. adults have no emergency savings at all. Let’s change those statistics for the better!

Starting an emergency fund builds financial security and confidence for the years to come. To do so, determine a practical, realistic amount of money you can dedicate to this fund every month or paycheck. It can be $10…$100…it all depends on your lifestyle and how much money you can allocate to this fund.

Keep this money in a separate account. We recommend a savings account because it is easily accessible, but not convenient enough to tempt you to spend the money. Consider using a high-yield savings account; they typically reward you with a higher interest rate than normal, meaning you have a higher annual percentage yield (APY). An APY is the total interest earned by putting money into an account. Additionally, set up automatic payments that put money directly into this account to make consistent saving contributions.

Aim to have at least three to six months’ worth of expenses saved in this fund. Do not use your emergency fund whenever you need some extra cash. It is for emergencies such as car repairs, medical bills, or loss of income. It is meant to be a safety net of savings, and you don’t want to use it before you have to.

2024 Here We Come!

How are you planning for your financial future? Try to implement one of these financial resolutions in 2024…or all three! 1166 FCU is here to help you reach your financial goals for 2024!

for more information contact us or call us at (856) 542-9241 to speak to a team member.